Indian Bank Net Banking

Online banking has transformed the traditional banking experience, eliminating the need for frequent branch visits, the inconvenience of waiting in queues, and the challenges of dealing with a cashier for your banking requirements. This paradigm shift is equally applicable to the realm of Indian bank net banking.

In the realm of online banking, the IFSC code assumes a pivotal role, serving as a crucial element in ensuring seamless internet banking transactions and swift money transfers. This alphanumeric code facilitates hassle-free, paperless transactions with prompt validation and confirmation.

Not only does the IFSC code play a pivotal role in error-free transactions, but it also serves to identify the specific bank and branch involved in the transfer of funds. With the IFSC code, users gain the ability to transfer funds instantly, without any delays, from any location at any time. The only prerequisite is access to an online banking account with the relevant bank.

It is essential, however, to possess comprehensive knowledge about online banking and its mechanisms. For an in-depth understanding of Indian bank net banking, refer to the following blog that provides detailed insights into the subject.

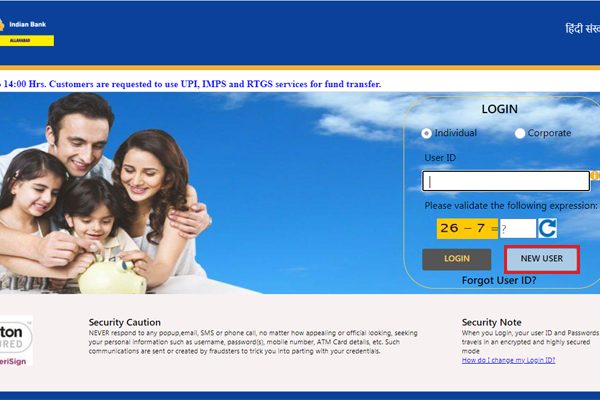

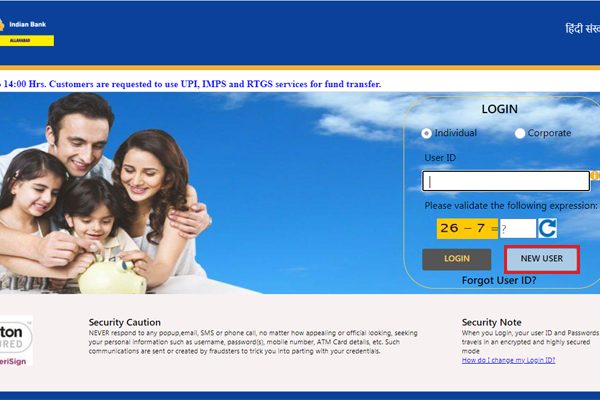

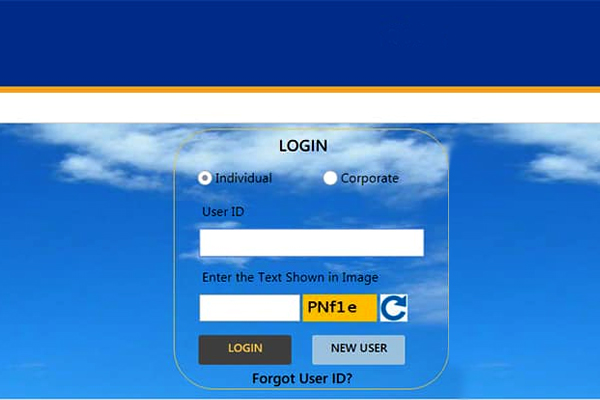

1) Navigate to the Indian Bank online portal at https://www.indianbank.net.in/jsp/startIB.jsp.

2) Select the 'New User' option.

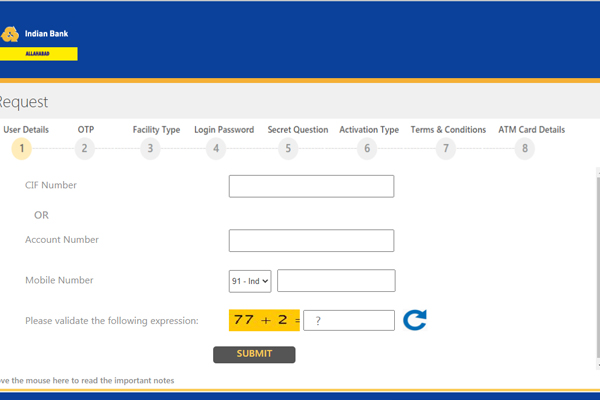

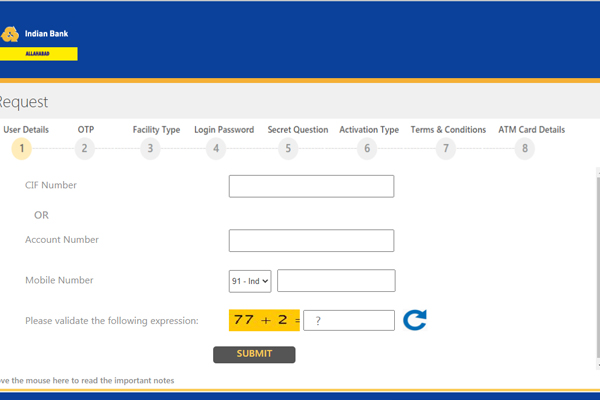

3) Input the account number, mobile number, and captcha.

4) Enter the One-Time Password (OTP) received on your registered mobile number.

5) Opt for either the View and Transaction feature or choose the View-only option.

6) Receive a login ID and password.

7) Input the provided details and choose.

8) Initiate activation via branch – Customers must print the downloaded application and visit the branch to activate internet banking.

9) Activate through ATM – Input ATM details.

10) Agree to terms and conditions.

11) Select submit.

Facilitating online fund transfers involves utilizing IFSC codes for transactions. Customers can choose between NEFT, RTGS, and IMPS for their online transfers, and it's crucial to have the IFSC code of the specific bank branch where the funds are to be transferred.

This requirement holds true for Indian Bank transactions as well. NEFT processes funds in batches, while RTGS ensures real-time transfers at any hour of the day. RTGS is particularly suitable for high-value transactions that demand immediate clearing. Meanwhile, IMPS empowers Indian Bank customers with instantaneous online transactions, accessible 24/7, even on public holidays and Sundays.

Here's a step-by-step guide:

1. Log in to your Indian Bank net banking account.

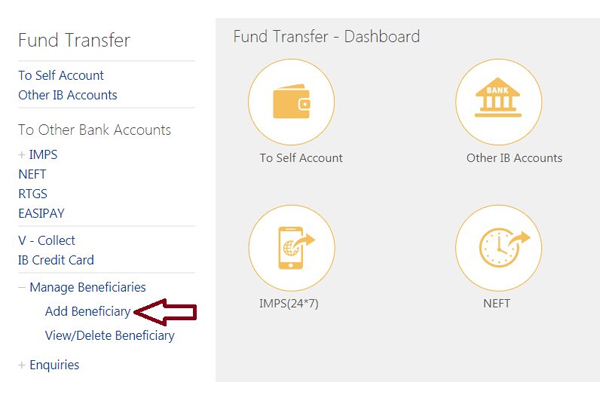

2. Navigate to the 'Funds Transfer' section.

3. Select 'Other IB Accounts' to transfer funds to another Indian bank account.

4. Fill in your details in the 'From Account' section and enter the beneficiary's Indian Bank IFSC code.

5. If the transfer is to a bank other than Indian Bank, choose 'Other Banks for NEFT.'

6. Input the transaction password.

7. Confirm the transaction by clicking 'Confirm.'

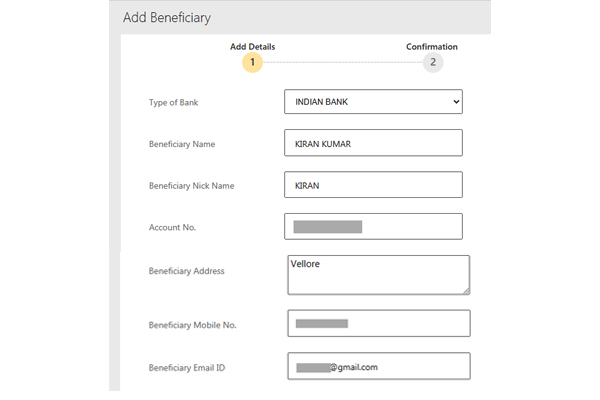

1) Navigate to the official website of Indian Bank at https://www.indianbank.net.in/jsp/startIB.jsp.

2) Log in to your Indian Bank online account.

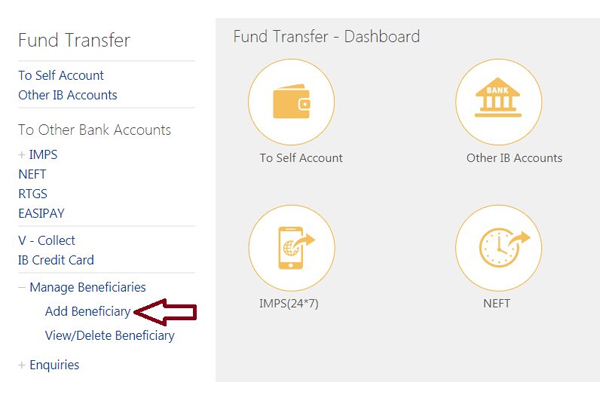

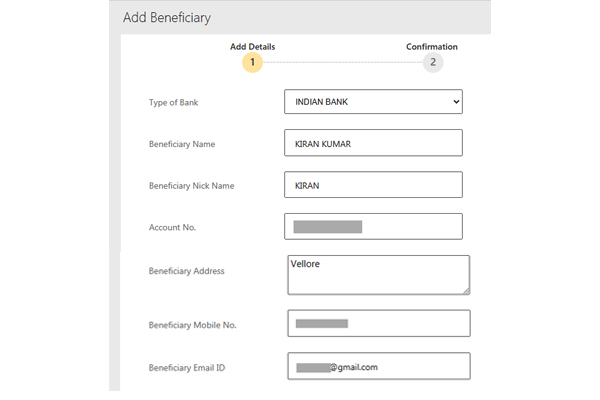

3) Select the 'Add beneficiary' option.

4) Access a webpage on the site where you will encounter a form.

5) Complete the necessary information for the beneficiary you intend to include.

6) Select the "Add" option.

7) Receive an OTP on your registered mobile number.

8) Enter the five-digit OTP and click on the designated button.

You can find full IFSC codes HERE

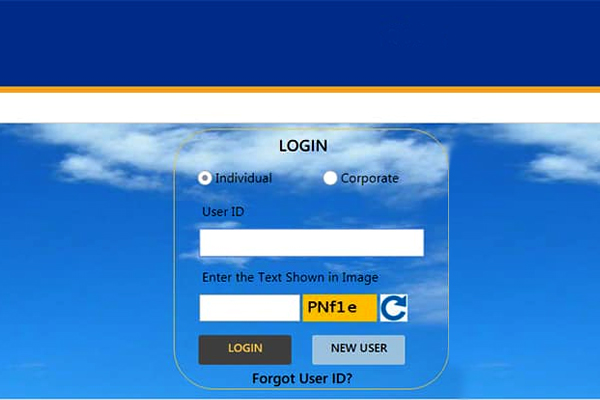

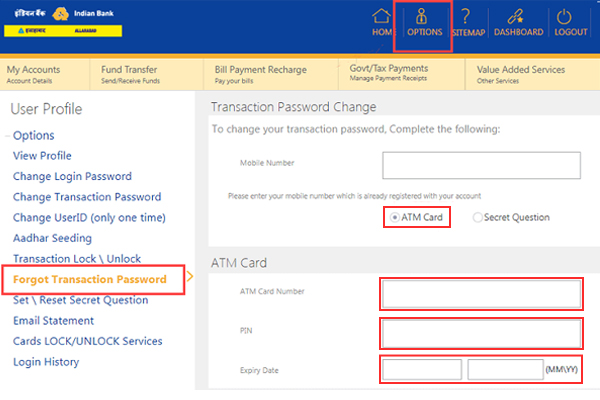

1) Provide your User ID and password on the Indian Bank net banking portal.

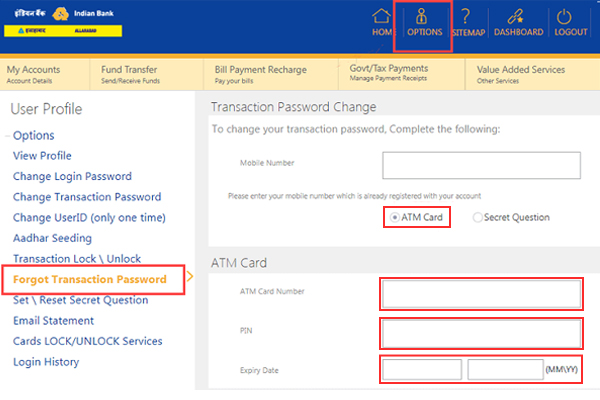

2) Upon successful login, navigate to the top of the screen and click on the "Options" tab.

3) Choose the "Forget Transaction Password" option.

4) Choose the ATM card option.

5) Provide the necessary information, including the debit card number, ATM PIN, and expiration month and year.

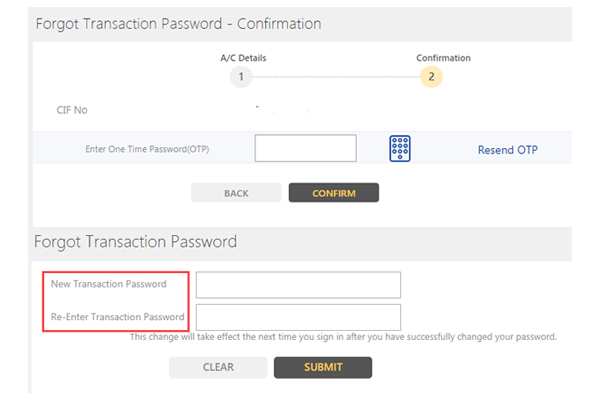

6) Input the OTP.

7) Once the accurate OTP is provided, the website will guide you to a subsequent screen.

8) At this point, you have the option to generate a new transaction password. Confirm the newly created password and proceed with the submission.

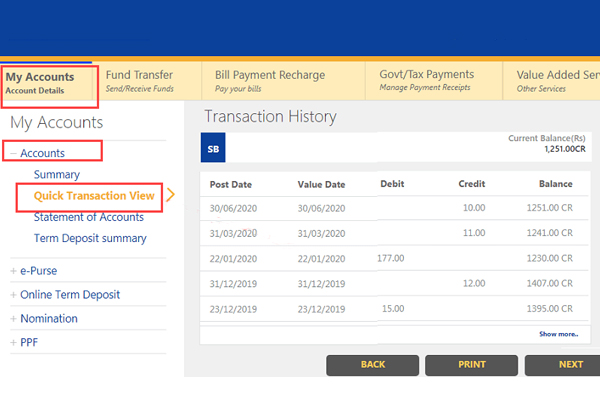

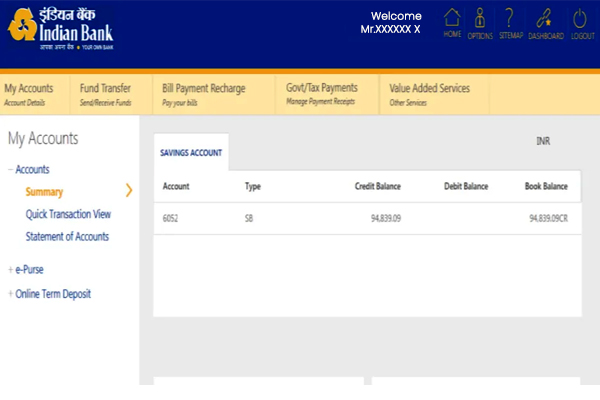

1) Access your Indian bank net banking account.

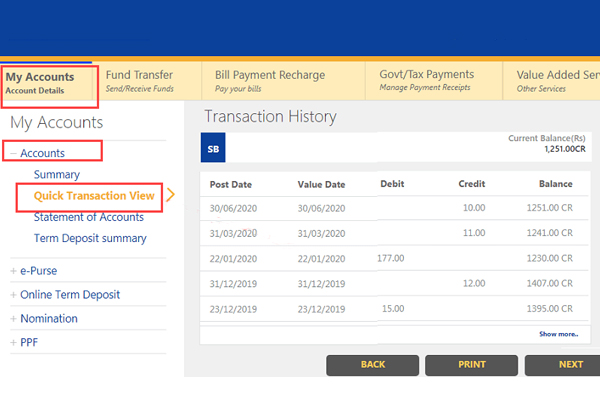

2) After logging in, navigate to the 'Accounts' tab, located on the left side of the screen.

3) View your account balance on the page.

4) Select the statement option to review the most recent transactions.

1) Compose an application letter including your name, account number, and mobile number.

2) Bring along a photocopy of your ID proof.

3) Ensure both the application and photocopy bear your signature.

4) Visit your account-holding branch and submit the documents to the bank.

The user ID for Indian Bank net banking is the unique identifier provided by the bank for logging in. It can either be the account number or a combination of letters and numbers issued during enrollment.

No, Indian Bank IMPS facilitates only fund transfers. There is no provision for withdrawing or depositing funds through this service.

The Indian Bank IFSC code is crucial for identifying the correct branch and location of the payee account for efficient fund processing. Providing an incorrect IFSC code will result in an incomplete transaction. The transferred amount will be returned to your account, ensuring that you do not lose money. However, the resolution process may take some time.

To unlock the transaction password, log in to your Indian Bank net banking account. Navigate to the "Options" section, where you will find the "Lock/Unlock Transaction Password" option. Click on it to unlock the password.

Ensure that your net banking password is robust, incorporating a combination of letters, numbers, and characters. It is advisable to periodically change your net banking password. Additionally, refrain from using public computers for net banking to enhance security.

You can find full IFSC codes HERE

In the realm of online banking, the IFSC code assumes a pivotal role, serving as a crucial element in ensuring seamless internet banking transactions and swift money transfers. This alphanumeric code facilitates hassle-free, paperless transactions with prompt validation and confirmation.

Not only does the IFSC code play a pivotal role in error-free transactions, but it also serves to identify the specific bank and branch involved in the transfer of funds. With the IFSC code, users gain the ability to transfer funds instantly, without any delays, from any location at any time. The only prerequisite is access to an online banking account with the relevant bank.

It is essential, however, to possess comprehensive knowledge about online banking and its mechanisms. For an in-depth understanding of Indian bank net banking, refer to the following blog that provides detailed insights into the subject.

How to enable internet banking with Indian Bank:

1) Navigate to the Indian Bank online portal at https://www.indianbank.net.in/jsp/startIB.jsp.

2) Select the 'New User' option.

3) Input the account number, mobile number, and captcha.

4) Enter the One-Time Password (OTP) received on your registered mobile number.

5) Opt for either the View and Transaction feature or choose the View-only option.

6) Receive a login ID and password.

7) Input the provided details and choose.

8) Initiate activation via branch – Customers must print the downloaded application and visit the branch to activate internet banking.

9) Activate through ATM – Input ATM details.

10) Agree to terms and conditions.

11) Select submit.

How to Conduct Online Fund Transfers using IFSC Code

Facilitating online fund transfers involves utilizing IFSC codes for transactions. Customers can choose between NEFT, RTGS, and IMPS for their online transfers, and it's crucial to have the IFSC code of the specific bank branch where the funds are to be transferred.

This requirement holds true for Indian Bank transactions as well. NEFT processes funds in batches, while RTGS ensures real-time transfers at any hour of the day. RTGS is particularly suitable for high-value transactions that demand immediate clearing. Meanwhile, IMPS empowers Indian Bank customers with instantaneous online transactions, accessible 24/7, even on public holidays and Sundays.

Here's a step-by-step guide:

1. Log in to your Indian Bank net banking account.

2. Navigate to the 'Funds Transfer' section.

3. Select 'Other IB Accounts' to transfer funds to another Indian bank account.

4. Fill in your details in the 'From Account' section and enter the beneficiary's Indian Bank IFSC code.

5. If the transfer is to a bank other than Indian Bank, choose 'Other Banks for NEFT.'

6. Input the transaction password.

7. Confirm the transaction by clicking 'Confirm.'

How to include beneficiaries in an Indian bank:

1) Navigate to the official website of Indian Bank at https://www.indianbank.net.in/jsp/startIB.jsp.

2) Log in to your Indian Bank online account.

3) Select the 'Add beneficiary' option.

4) Access a webpage on the site where you will encounter a form.

5) Complete the necessary information for the beneficiary you intend to include.

6) Select the "Add" option.

7) Receive an OTP on your registered mobile number.

8) Enter the five-digit OTP and click on the designated button.

You can find full IFSC codes HERE

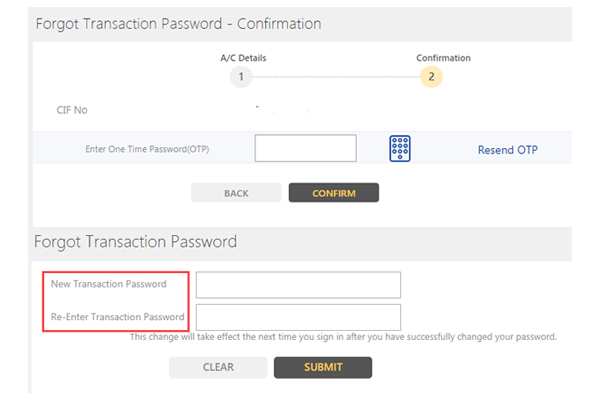

How to initiate a Transaction Password Reset in Indian Bank?

1) Provide your User ID and password on the Indian Bank net banking portal.

2) Upon successful login, navigate to the top of the screen and click on the "Options" tab.

3) Choose the "Forget Transaction Password" option.

4) Choose the ATM card option.

5) Provide the necessary information, including the debit card number, ATM PIN, and expiration month and year.

6) Input the OTP.

7) Once the accurate OTP is provided, the website will guide you to a subsequent screen.

8) At this point, you have the option to generate a new transaction password. Confirm the newly created password and proceed with the submission.

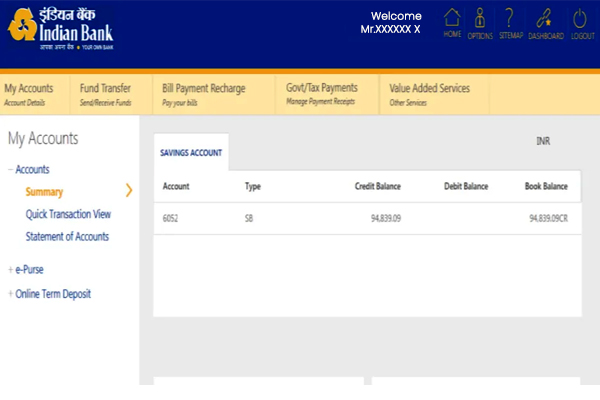

How to Verify the Balance in an Indian Bank Account:

1) Access your Indian bank net banking account.

2) After logging in, navigate to the 'Accounts' tab, located on the left side of the screen.

3) View your account balance on the page.

4) Select the statement option to review the most recent transactions.

Guidelines for Registering a Mobile Number with an Indian Bank:

1) Compose an application letter including your name, account number, and mobile number.

2) Bring along a photocopy of your ID proof.

3) Ensure both the application and photocopy bear your signature.

4) Visit your account-holding branch and submit the documents to the bank.

Limits and Fees Applicable to Transactions:

| Transfer Mode | Maximum Transfer limit (Per Day) | Charges |

NEFT | Rs 25 lakhs | Up to Rs 10,000; Rs 3 / transaction Rs 10,000- Rs 1 lakh – Rs 6 Rs 1 lakh – Rs 2 lakh – Rs 14 Rs 2 lakh and above – Rs 29 |

| IMPS | Rs 2 lakhs | Up to Rs 25,000 – none Rs 25,000 – Rs 2 lakh – Rs 6 |

| RTGS | Minimum – Rs 2 lakh Maximum – Rs 25 lakhs | Rs 2 lakh – Rs 5 lakh – Rs 29 plus tariff Rs 5 lakh and above – Rs 58 plus tariff |

Frequently Asked Questions (FAQs):

1. What serves as the user ID for Indian Bank net banking?

The user ID for Indian Bank net banking is the unique identifier provided by the bank for logging in. It can either be the account number or a combination of letters and numbers issued during enrollment.

2. Is it possible to withdraw or deposit funds using Indian Bank IMPS?

No, Indian Bank IMPS facilitates only fund transfers. There is no provision for withdrawing or depositing funds through this service.

3. What happens if an incorrect Indian Bank IFSC code is provided?

The Indian Bank IFSC code is crucial for identifying the correct branch and location of the payee account for efficient fund processing. Providing an incorrect IFSC code will result in an incomplete transaction. The transferred amount will be returned to your account, ensuring that you do not lose money. However, the resolution process may take some time.

4. How can I unlock the transaction password for Indian Bank online banking if it's accidentally locked?

To unlock the transaction password, log in to your Indian Bank net banking account. Navigate to the "Options" section, where you will find the "Lock/Unlock Transaction Password" option. Click on it to unlock the password.

5. What security tips should I follow when using Indian Bank net banking services?

Ensure that your net banking password is robust, incorporating a combination of letters, numbers, and characters. It is advisable to periodically change your net banking password. Additionally, refrain from using public computers for net banking to enhance security.

You can find full IFSC codes HERE